Vistra Corp (VST)

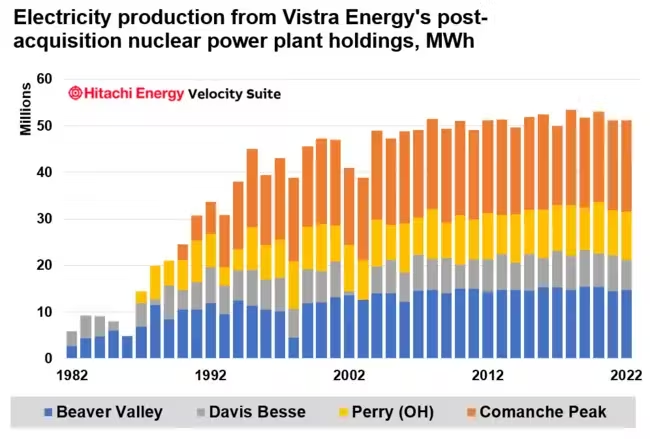

Companies like Vistra Corp. are benefiting from surging investments in nuclear energy to meet skyrocketing electricity demand from AI and data centers. Vistra’s stock soared 258% in 2024 and added 30% more in 2025, backed by strategic expansions in natural gas, storage, solar, and a raised 2026 EBITDA forecast anchored by growing dual NYSE listings and sovereign investment.

Surging stock performance driven by AI/data center demand; strategic expansion and solar/storage investments; corporate backing and raised forecasts offer strong growth narrative.

NextEra Energy (NEE)

While oil majors face continued political and long-term concerns, nuclear benefits from favorable regulatory tailwinds and tech-forward narratives. Articles highlight nuclear as the fastest-growing low-carbon solution attracting capital via SPACs and policy support.

Strong free cash flow from traditional operations; strategic investments in low-carbon initiatives like carbon capture, biofuels, and hydrogen give it adaptability amid energy transition.

ExxonMobil (XOM)

While oil majors face continued political and long-term concerns, nuclear benefits from favorable regulatory tailwinds and tech-forward narratives. Articles highlight nuclear as the fastest-growing low-carbon solution attracting capital via SPACs and policy support.

The world’s largest utility by market cap, with huge renewable capacity (wind, solar) and a clear reducing reliance on fossil fuels—from ~41% fossil in 2020 to ~36% by March 2025.